How Wealth Management can Save You Time, Stress, and Money.

About Wealth Management

Table of Contents4 Easy Facts About Wealth Management Explained9 Easy Facts About Wealth Management DescribedFacts About Wealth Management RevealedWealth Management Fundamentals ExplainedThe 7-Minute Rule for Wealth Management

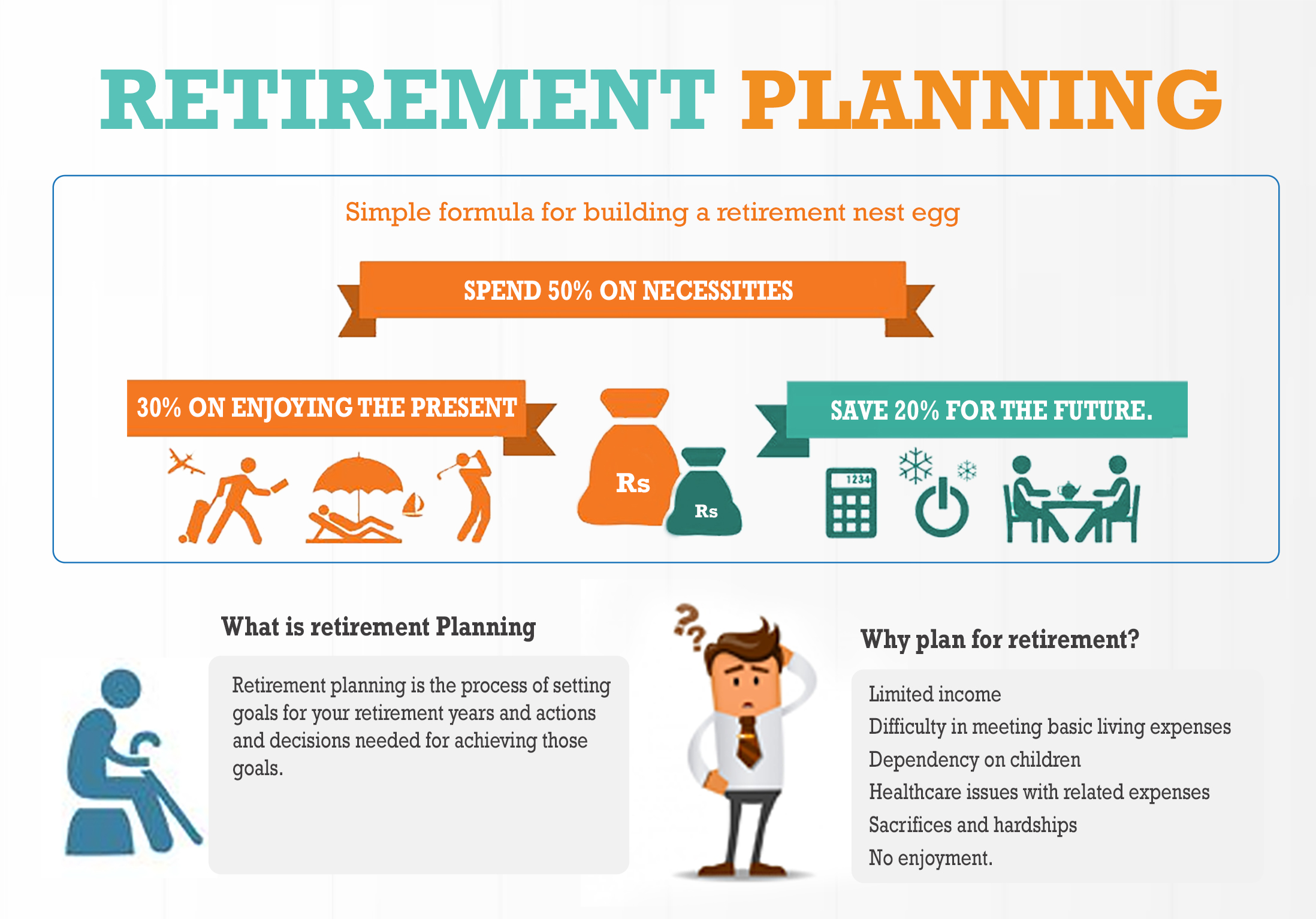

The non-financial elements consist of lifestyle selections such as just how to spend time in retirement, where to live, as well as when to stop working altogether, to name a few points. An alternative approach to retirement planning takes into consideration all these areas. The focus that a person puts on retirement planning modifications at various phases of life.

Others claim most retired people aren't saving anywhere near sufficient to meet those standards as well as need to change their way of living to survive on what they have. While the amount of cash you'll want to have in your savings is necessary, it's likewise an excellent concept to take into consideration all of your costs.

Excitement About Wealth Management

And also given that you'll have much more spare time on your hands, you might also intend to element in the price of entertainment as well as traveling. While it might be tough to come up with concrete figures, be sure ahead up with an affordable price quote so there are no surprises later on.

Regardless of where you remain in life, there are numerous vital steps that put on practically every person during their retirement preparation. The complying with are some of one of the most usual: Develop a plan. This includes deciding when you wish to begin conserving, when you desire to retire, as well as exactly how much you would certainly like to conserve for your utmost objective.

Examine on your investments from time to time and also make routine adjustments. Retirement accounts come in several shapes and sizes.

You can as well as must contribute greater than the quantity that will certainly make the employer suit. Some specialists suggest up of 10%. For the 2023 tax year, participants under age 50 can contribute approximately $22,500 of their revenues to a 401( k) or 403( b) (up from $20,500 for 2022), some of which might be furthermore matched by a company. wealth management.

Some Ideas on Wealth Management You Should Know

The traditional private retirement account (INDIVIDUAL RETIREMENT ACCOUNT) lets you place apart pre-tax dollars. This indicates that the cash you save is deducted from your revenue prior to your taxes are taken out. It decreases your taxable earnings and also, as a result, your tax liability. So if you get on the cusp of a higher tax brace, buying a typical individual retirement account can knock you down to a reduced one.

When it comes time to take distributions from the account, you are subject to your typical tax obligation rate at that time. the original source Keep in mind, however, that the cash grows on a tax-deferred basis.

Roth IRAs have some constraints. The payment limit for either IRA (Roth or typical) is $6,500 a year, or $7,500 if you more than age 50. Still, a Roth has some earnings limits: A single filer can add the total just if they make $129,000 or much less each year, since the 2022 tax obligation year, and $138,000 in 2023.

An Unbiased View of Wealth Management

It functions the same way a 401( k) does, enabling employees to save cash instantly via pay-roll reductions with the option of a company suit. This quantity is capped at 3% of an employee's yearly wage.

Catch-up payments my explanation of $3,500 permit employees 50 or older to bump that limitation up to $19,000. As soon as you established up a retirement account, the inquiry becomes exactly how to route the funds.

Below are some standards for successful retired life planning at different stages of your life., which is a vital and important piece of retirement cost savings.

Also if you can just place apart $50 a month, it will certainly be worth three times extra if you spend it at age 25 than if you wait to begin investing until age 45, thanks to the happiness of worsening. my explanation You might be able to invest even more cash in the future, yet you'll never ever be able to make up for any kind of lost time.

Our Wealth Management PDFs

Nevertheless, it's essential to continue conserving at this stage of retirement planning. The combination of gaining even more money as well as the time you still need to invest and make rate of interest makes these years some of the most effective for aggressive savings. People at this phase of retirement preparation must continue to capitalize on any 401( k) matching programs that their companies provide.